Virtual cards are an essential tool in media buying. They help pay for ads, manage budgets, and ensure campaign stability. To ensure that a card can handle these tasks effectively, several factors must be considered. Each advertising platform accepts payments in its own currency. The card should match this currency to avoid unnecessary conversion fees. Even more importantly, its compatibility with platforms is crucial. If a platform blocks payments due to a BIN code, campaigns can be halted. For large budgets, a card with appropriate limits is required. This allows marketers to avoid frequent top-ups and stay focused on the ads themselves. Top-ups must be fast, especially when dealing with cryptocurrency. Card security eliminates the risk of failures. Features like 3D Secure support and the ability to block transactions help protect funds from fraud.

Next, we will review three popular solutions used by media buying teams. Let’s take a look at how PSTNET, Bankera, and Funcwallet perform in these tasks.

-

PSTNET

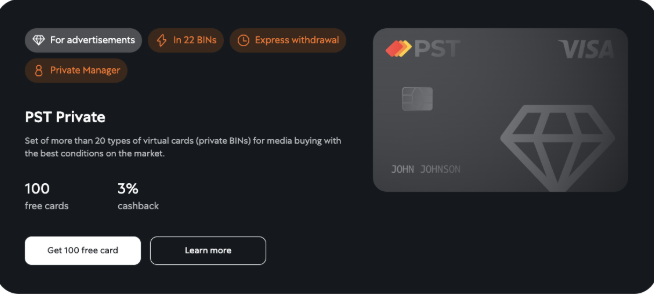

PSTNET offers virtual cards designed for media buying, with settings that fit popular advertising platforms. PSTNET cards can be issued with no limits, and users can choose either a universal credit card for advertisement or create specific cards for each platform. The service provides tools for managing cards, analyzing spending, and collaborating within teams. Some key advantages of PSTNET cards include no transaction fees, free fund withdrawals, and operations with blocked or frozen cards.

Additionally, PSTNET offers the PST Private program. This program gives a 3% cashback on ad spending, allows up to 100 cards to be issued each month for free, and reduces top-up fees to 3%. The subscription is ideal for those working with large budgets and looking to cut costs.

Technical specifications:

- Number of BINs: 25+ trusted BINs from U.S. and European banks

- Payment system: Visa, Mastercard

- Card types: Credit, Debit

- Fiat currencies: USD, EUR

- Cryptocurrencies: 18 coins (BTC, USDT TRC20, ERC20, and others)

- Security technologies: 3D Secure, 2FA

- Balance top-up: Crypto, SWIFT/SEPA bank transfers, other Visa/Mastercard cards

- Registration time: 1 minute

- Registration: Apple ID, Google, Telegram, WhatsApp, or email accounts

-

Bankera

Bankera is a financial solution licensed by the Lithuanian government. The service issues both digital and physical cards for business needs. Key features include multi-currency account support and cryptocurrency transactions. Transactions are limited to 100,000 EUR per day or 300,000 EUR per month. Bankera also has a fee structure. Account opening starts at 450 EUR for non-EU or non-UK companies. Service fees can reach 200 EUR per month for those using cryptocurrencies, or 50 EUR per month if not.

Technical Specifications:

- Number of BINs: 8 BINs from European banks

- Payment system: Visa

- Card type: Debit

- Fiat currencies: USD, EUR, GBP

- Cryptocurrencies: 16 coins (USDT TRC20, ERC20, and others)

- Security technologies: 3D Secure

- Balance top-up: SEPA/SWIFT bank transfers, other Visa/Mastercard cards, SpectroCoin platform

- Registration time: Registration may take up to 10 days

- Registration: Includes user data verification and account activation approval

-

Funcwallet

Funcwallet is a platform for managing finances via a cryptocurrency wallet and issuing virtual cards. The user interface is minimalist. Users can view a list of issued cards and transaction history. Everything necessary for operation is available, but additional tools for analytics or team collaboration are not provided. Fees depend on the volume of transactions and the number of declined transactions. Top-ups through a crypto wallet start at 3%. Transaction fees begin at 1.5%, but they may increase with frequent declines.

Technical specifications:

- Number of BINs: 3 BINs from European banks

- Payment system: Visa, Mastercard

- Card types: Debit, Prepaid

- Fiat currencies: USD, EUR

- Cryptocurrencies: USDT (TRC20, ERC20)

- Security technologies: Double encryption

- Balance top-up: Cryptocurrencies, Visa/Mastercard cards, and internal transfers between wallet holders

- Registration time: Up to 24 hours

- Registration: Form filling and user data verification, followed by waiting for system approval

For successful media buying, it’s crucial that the virtual card supports the necessary currencies and is compatible with platform BIN code requirements. This will avoid payment issues and campaign halts. For large budgets, cards with appropriate limits are a good fit, as they reduce the need for frequent top-ups and allow you to focus on advertising. Fast top-ups are critical, especially when dealing with cryptocurrency. Equally important is security: 3D Secure support and the ability to block transactions help protect funds from fraud. By considering all these factors, you can choose a card that ensures smooth campaign operation and minimizes technical risks.

PSTNET, Bankera, and Funcwallet offer different approaches to solving media buying challenges. PSTNET stands out due to its combination of benefits. The cards offer both cashback and team collaboration tools, along with optimal technical specifications. However, the pricing might be high for smaller teams and budgets. Bankera leans toward traditional banking, with highly reliable cards that are well-accepted by advertising platforms. However, the registration process is quite lengthy, and card issuance fees can be high. Funcwallet offers fast card issuance and is quite user-friendly, thanks to its simple interface. However, it has a limited number of BINs and uses more conservative transaction security methods.

Overall, each solution in our ranking is the best in its own way. Media buying teams worldwide use all of these services. The optimal card choice ultimately depends on business priorities, not popularity. We hope this article helps your team choose the best payment solution.